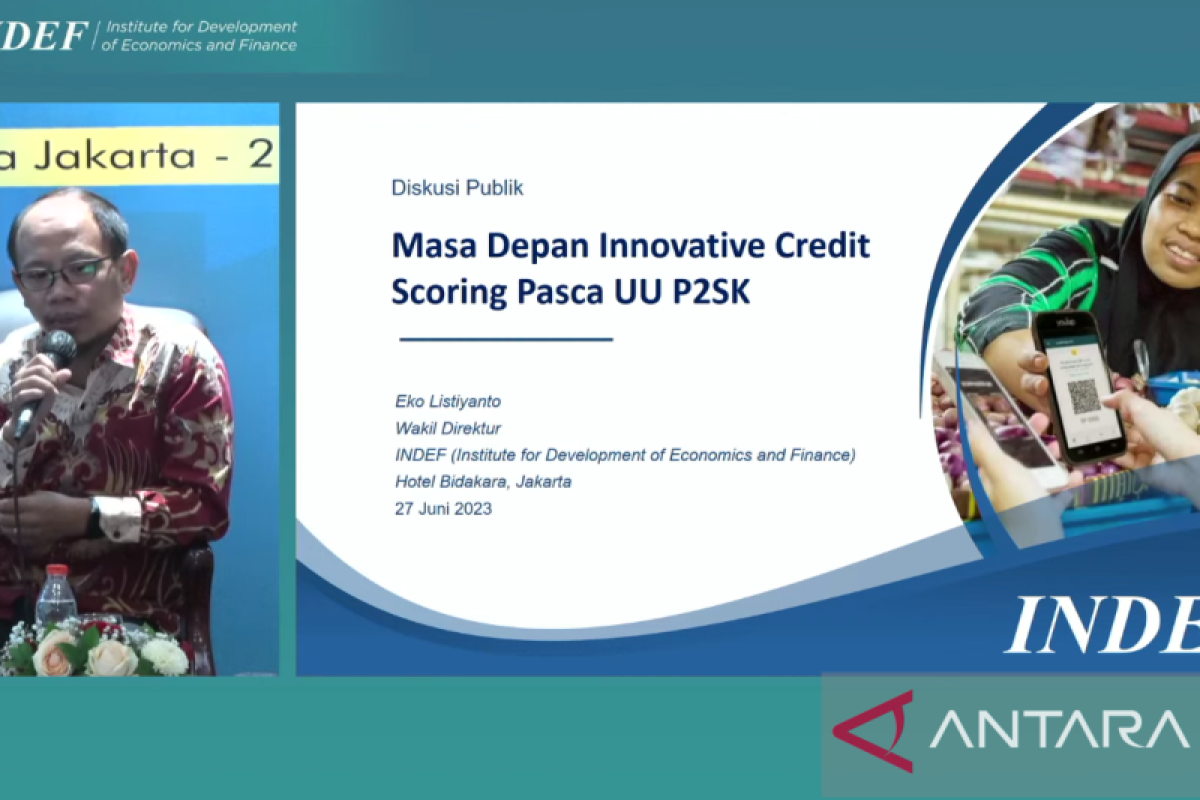

At a public discussion titled "The Future of Innovative Credit Scoring after the Financial Sector Development and Strengthening Law (UU P2SK)" here, Tuesday, he noted that opportunities should be provided to unbanked and underbanked people.

It will cause inequality if only banked people are encouraged, while the same is not offered to unbanked people, he pointed out. According to Listiyanto, several micro, small, and medium enterprises (MSMEs) in the country still have limited access to finance amid the increasing need for access to business capital. "Financial access can improve the community's economic welfare. The bigger the MSMEs, the more they need access to finance," he remarked.

The result of the National Financial Literacy and Inclusion Survey (SNLK) conducted by the Financial Services Authority (OJK) showed that the financial inclusion index in Indonesia had improved with each passing year. In 2013, the financial inclusion index in Indonesia stood at 60 percent and then increased to 68 percent in 2016, 76 percent in 2019, and again rose to 85 percent in 2022.

Listiyanto explained that based on the survey, 85 percent of Indonesian citizens already have access to financial services, while 15 percent of citizens are categorized as unbanked. "Actually, financial inclusion in Indonesia is improving from time to time, but we have a higher target, (namely reaching) 90 percent next year," he remarked.

Baca juga: Indef rekomendasikan pemerintah dorong PMTB

Baca juga: Indef ingatkan pemerintah antisipasi dampak gagal bayar utang

Nevertheless, he said, the national achievement is still behind that of several other nations and even Southeast Asian countries. Based on the World Bank report, Indonesia's financial inclusion stood at 51 percent in 2021, or below several other Southeast Asian countries, such as Vietnam, with around 58 percent; Malaysia, at 90 percent; Thailand, 95 percent; and Singapore, 98 percent. "Thus, more extra efforts from the government and all stakeholders are needed, so that our inclusion index can improve. It is already in an upward trend, but (we) still need to work hard," he remarked.

Pewarta : Muhammad Heriyanto, Raka Adji

Editor:

I Komang Suparta

COPYRIGHT © ANTARA 2026